What is Environmental, Social, and Governance (ESG)?

In recent years, environmental, social, and governance (ESG) reporting has gone from being a good idea to a critical business practice — one that governments and younger generations of consumers are closely attuned to.

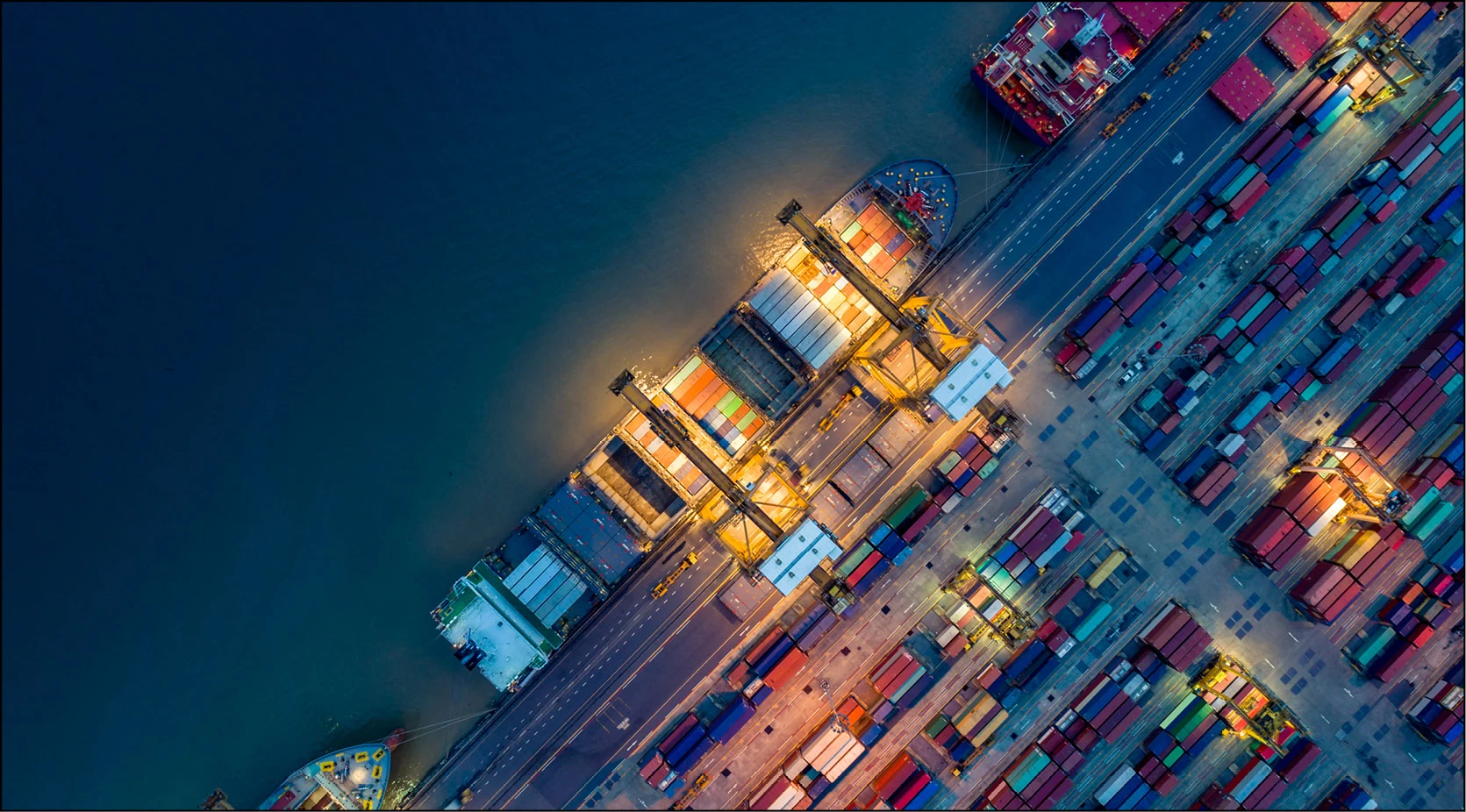

Though ESG investing helped embed the concept of ESG into the public’s consciousness, supply chain ESG has dominated the conversation in recent years. The public and regulators hold brands accountable for environmental damages, social and labor issues, and governance policies that determine how companies disclose information and establish accountability.

What is ESG?

Environmental, social, and governance (ESG) is a framework used to measure the sustainability and ethical impact of companies. ESG status directly affects financers’ capital allocation decisions and investors’ and stakeholders’ perceptions of financial health.

However, ESG is more than a cost — it is now a way to create business value. Companies that take ESG seriously are able to tap into new markets, reduce costs and regulatory interventions, boost employee productivity and retention, and optimize asset allocation.

ESG overview

The principle of ESG can be broken down into three pillars:

-

Environmental

The environmental pillar of ESG focuses on a company’s impact on the environment, including issues like CO2 emissions, overall carbon footprint, water usage, pollution, and waste management processes.

-

Social

The social pillar of ESG includes social issues, such as workplace diversity, worker safety, child or forced labor, protections for whistleblowers, community engagement, and sourcing of controversial materials like conflict minerals.

-

Governance

The third pillar focuses on how a company runs its internal operations, including meeting stakeholder needs, political contributions, enforcement policies, hiring practices, compliance with laws and standards, and transparency with the public.

With supply chain ESG, these pillars reside deep within global production networks — where conventional management tools provide little to no visibility. However, with the emergence of new technologies in recent years, it has become possible to monitor and influence the happenings on factory floors in real-time.

Why ESG is important

ESG is becoming increasingly important for several reasons. Firstly, investors are increasingly interested in aligning their investments with their values and concerns for the environment and society. ESG provides a framework for evaluating companies based on their sustainability and social responsibility.

Second, companies prioritizing ESG practices are more likely to generate positive long-term returns and avoid environmental, social, and governance risks. For example, companies prioritizing energy efficiency and renewable energy are better positioned to transition to a low-carbon economy, and those prioritizing employee health and safety will likely avoid costly lawsuits and reputational damage.

Third, the ESG framework is a way to ensure that companies are held accountable and disclose their sustainability efforts. Transparency has become essential to corporate social responsibility as governments continue raising the bar on climate action.

ESG criteria

ESG criteria refer to the standards investors and companies use to evaluate a company’s environmental, social, and governance practices. ESG criteria measure a company’s performance on various factors beyond financial metrics to determine its long-term sustainability and impact on society and the environment.

Investors often use ESG criteria to evaluate potential investments and companies to assess their performance and identify improvement areas. ESG criteria can be used to evaluate companies in any industry and are increasingly becoming a critical part of investment decision-making.

The following are the key components of ESG criteria:

Environment

- Transparent reporting on carbon footprint and sustainability metrics

- Active pursuit of lower greenhouse gas emissions

- Use of renewable energy in production

- Minimal waste production

- Stated timeline toward zero or net-zero emissions

Social

- Real-time monitoring of factory working conditions

- Policies protecting against sexual misconduct and workplace abuse

- Inclusion of a diverse workforce

- Avoidance of factories or regions with poor records of workplace safety and child labor

- Fair compensation

Governance

- A diverse board of directors

- Transparency with stakeholders

- Non-CEO chair of the board

- Board elections staggered over time

What ESG means for different sectors

The ESG framework has implications for companies in different sectors. When evaluating ESG criteria, companies in the technology sector may be held to different standards than those in the oil and gas industry.

For example, tech companies may be evaluated on their data privacy practices and usage of AI. In contrast, oil and gas companies may need to meet stricter carbon emissions and sustainability standards. Companies in both sectors must prioritize social responsibility, transparency, and compliance with laws and regulations.

Let’s take a closer look at what ESG means for different sectors.

Energy sector: Companies in the energy sector face significant environmental and social challenges such as climate change, air pollution, and natural resource depletion. To meet ESG criteria, these companies must disclose their carbon footprint, reduce greenhouse gas emissions and invest in renewable energy sources. They are also expected to prioritize health and safety measures for their employees and contractors and to engage with local communities to mitigate social impacts.

Financial sector: Financial institutions must incorporate ESG criteria into their investment decisions, assess the risks and opportunities associated with climate change, and disclose their carbon footprint. Additionally, they must promote diversity and inclusion within their organizations and combat money laundering and corruption.

Healthcare sector: Companies in the healthcare sector must prioritize patient health and safety, conduct clinical trials with integrity, disclose pricing policies, invest in research and development that benefits society, and ensure their supply chains are ethical.

Technology sector: Technology companies must address environmental and social impacts such as reducing their carbon footprint, promoting data privacy and security, combatting online hate speech and misinformation, promoting diversity within their organizations, and ensuring that their products do not contribute to social harm.

Consumer goods sector: Companies in the consumer goods sector are expected to reduce waste and packaging, source raw materials responsibly, promote fair labor practices, and disclose their supply chain practices. Additionally, they should engage with stakeholders to address social and environmental challenges.

Corporate ESG vs. Investor ESG vs. Regulatory ESG

When evaluating ESG criteria, it is important to understand the difference between corporate ESG, investor ESG, and regulatory ESG.

Corporate ESG focuses on how corporations manage their own ESG-related risks and opportunities. Corporate ESG aims to ensure that a company’s operations are sustainable and do not negatively impact the environment or society. A company’s ESG strategy typically includes goals, objectives, and initiatives related to environmental, social, and governance issues.

Investor ESG focuses on how an investor considers a company’s ESG performance when making investment decisions. This includes assessing a company’s ESG track record, its commitment to sustainability, and the impact of its products and services on the environment and society. For example, an investor may opt to invest in companies with strong ESG performance and exclude companies that do not meet specific standards.

Regulatory ESG is the compliance of a company’s ESG policies with relevant laws and regulations. Companies must ensure that their operations abide by local, state, and federal laws and regulations, such as labor rights, environmental protection, and consumer protection. Regulatory ESG also includes compliance with international standards and agreements, such as the Paris Agreement on climate change.

Advantages and Disadvantages of ESG

Advantages of ESG

Companies that embrace an ESG program put themselves in a favorable position in the near- and long term. ESG offers several advantages:

- Companies with good ESG scores are more competitive

A recent survey revealed that 64% of Americans are willing to spend extra money on sustainably-minded companies. That means a good ESG score makes you more attractive to most US consumers. Employees, regulators, and lenders also take careful note of ESG metrics, and companies that promote diversity and take ethical stands on socioeconomic issues put themselves in a strong position to win favor.

- ESG leads to investment and lending

Earnings reports that include ESG reporting are popular among investors and lenders, who actively look for companies with transparent ESG disclosure policies. That’s because strong ESG measures translate to low risk. With climate disasters, a pandemic, and exploited natural resources fresh on the public’s mind, investors and lenders are shifting toward sustainable businesses and disregarding those with antiquated practices.

- ESG lowers costs

Aside from the avoided cost of non-compliance fines, investing in ESG improves financial performance by streamlining workflows, cutting waste, making production more efficient, and reducing the use of paper. Tracking key metrics helps companies quantify how much they save with their ESG efforts.

- Customers are more loyal to ESG brands

ESG was gaining steam before the pandemic, but the period during and after saw a major growth in sentiment towards brands with ESG credentials. In a 2021 survey by Accenture, 50% of consumers reported that COVID-19 had changed their shopping priorities and made them more willing to buy from brands that valued ethical supply chains. Consistent, transparent reporting gains and builds customer loyalty.

- ESG makes operations more sustainable

Volatile market forces, geopolitical conflicts, and other major disruptions are increasingly common, and companies that adopt ESG policies avoid regulatory, reputational, and legal troubles down the road. With reduced resource waste, less energy consumption, and lower operational costs, brands become more sustainable with ESG programs in place.

Disadvantages of ESG

Although beneficial, ESG initiatives come with their own set of risks. With a new focus on sustainability comes increased scrutiny, and companies may be subject to governmental fines, shareholder actions, and other penalties if they violate ESG standards. Additionally, companies must consider the cost of implementing an ESG program, and the potential returns may be hard to quantify. Here are a few disadvantages of ESG:

- Quantifying results can be difficult

Putting a number on the value of “doing good” or having an ethical reputation is hard, but investors and other stakeholders require tangible evidence of ESG’s worth. Companies must establish measurable goals to demonstrate the impact of their initiatives, a task that can be difficult to accomplish.

- Costly to implement

ESG reporting may require large investments in data-gathering, staff training, and infrastructure changes that can quickly add up. Without a clear roadmap to success, implementing ESG policies could be expensive and time-consuming.

- Increased scrutiny

As companies put more resources into sustainability initiatives, they open themselves up to criticism from stakeholders who may disagree with their strategies. With the rise of social media, companies must be prepared for a potential PR crisis should any ESG-related missteps come to light.

Although some risks are involved with implementing ESG policies, their potential benefits make them worth considering for any business looking to strengthen its position in the market. Access to better talent pools, increased customer loyalty, improved operations, and the chance to win favor with investors and lenders make ESG worthwhile. Companies should take the time to understand and implement ESG policies that fit their operations, as this will likely be one of the significant drivers of success in the years to come.